A quick summary of important information about the Kontist account

- It’s a German account.

- The account is free of charge (no registration fee, no account management fees! For optional additional services, see price table)

- It is managed via an easy to use mobile app which is available for iOS and Android. A desktop version is also available

- It is very easy and quick to open a Kontist account using the online identification process

- When opening an account, there is no credit check inquiry (SCHUFA)

- Intended for other legal entities as well (GmbH, UG etc.)

Kontist is designed for the self-employed

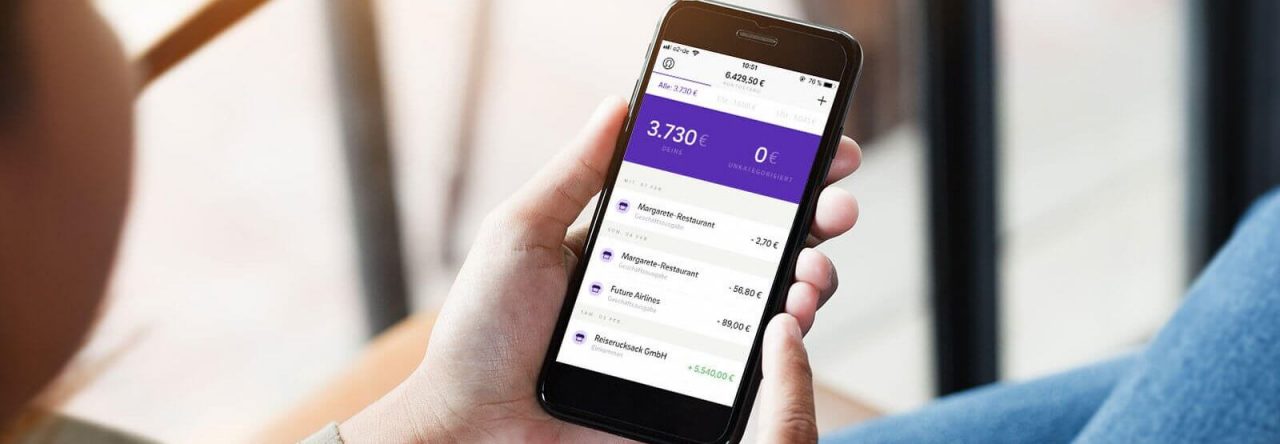

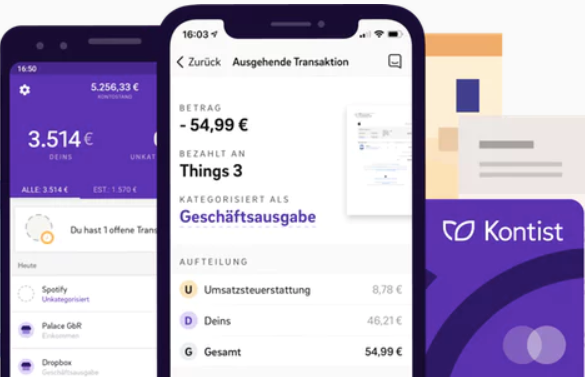

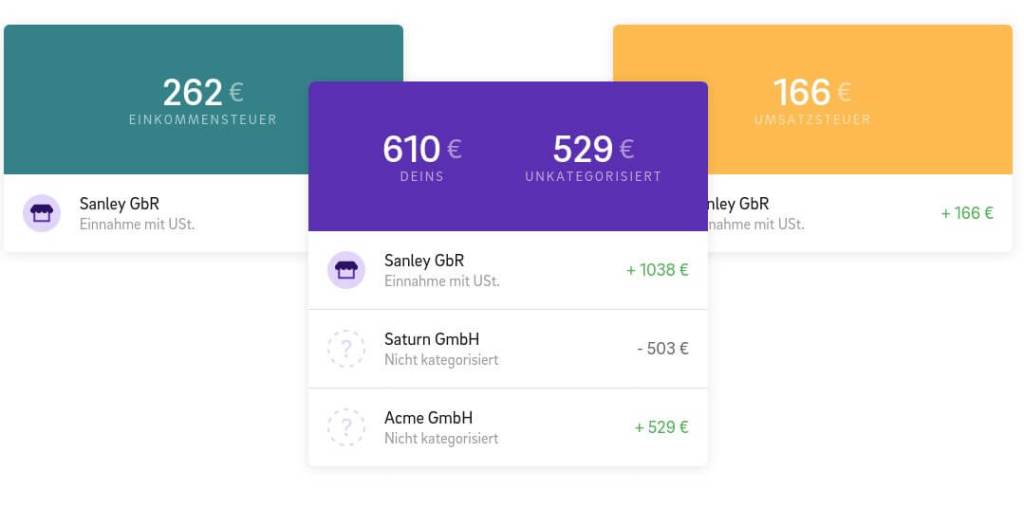

First of all: Behind the name Kontist is a German start-up based in Berlin. The team consists of people with different areas of expertise who work together towards one goal: the self-employed should be able to manage their finances without financial and administrative hurdles. And that is exactly what the account should enable. It’s actually very simple, but that’s what I find so awesome. Basically, Kontist categorizes every income into “yours, income tax, and sales tax” – or you choose to have it as a private income. Then 100% of the sum is booked in the category “yours”.

The Kontist account functions seamlessly with sub-accounts

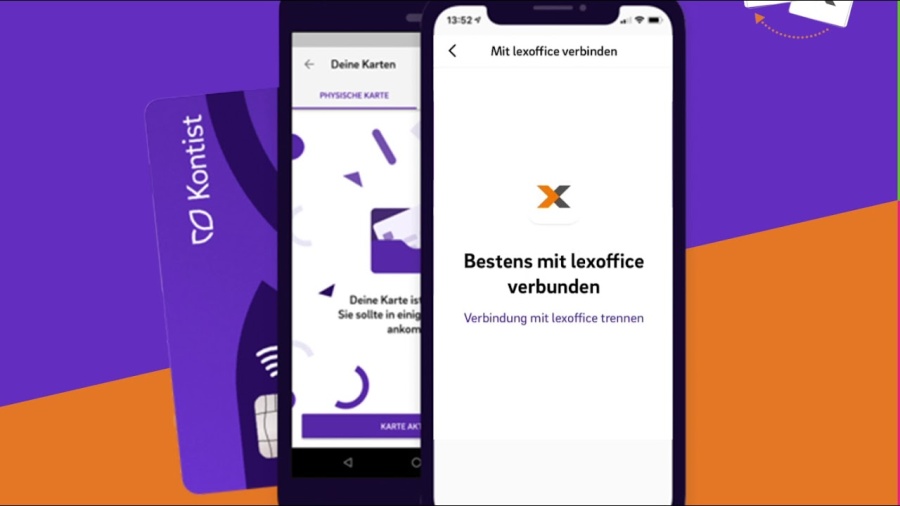

You manage the Kontist account via an app (iOS & Andriod) or on a desktop. I think it’s great that you can log into the app using your fingerprint

Virtual Kontist sub-accounts

Then you set up the basic settings. This means: You state what the percentage of your income tax and sales tax that you collect. Of course, you can change this information at any time. Kontist notifies you of a transaction and you can categorize the income as either private or business income. 100% of private income ends up in the “yours” category. In the case of business income, you briefly confirm the amount of the sales tax rate and the Kontist app automatically calculates how much money from the income ends up at the tax office for taxes as a percentage.

This virtual split is just super practical! Because this way you always have an eye on how much money of your earnings really belongs to you. And there are no nasty surprises when it comes to your tax return. 😉 You are constantly aware of your tax obligations.

To open a Kontist account costs nothing

You pay neither a one-time nor an ongoing account management fee for a German business account. That’s why you can open the account and try it out without hesitation. Whether you actively use it afterwards or not is up to you. If you require additional optional services, simply select them and pay for what you need.

Incidentally, the account is with solarisBank, “which is regulated by the Federal Financial Supervisory Authority (BaFin)”. All financial and user data is transmitted in encrypted form and also secured by two-factor authentication.

It’s very easy to open a Kontist account

If you want to open a Kontist account, you can do so within a few minutes using an online identification process. Open an account here

Easy steps to opening a Kontist account:

- If you are currently at a desktop, all you need to do is enter your email address and the download link for the app will be sent to you. If you are currently on your mobile phone, click on the App Store button.

- Download the app and register.

- You then carry out the online identification process via smartphone. Have your ID card ready and make sure you have a good internet connection. Incidentally, the identification takes max. 10 mins.

- Finished! After successfully completing the identification process, you can make the basic settings for your account.

The Kontist pros outweigh the cons

We can easily recommend the Kontist account because it is the ideal banking solution for the self-employed.

Pros

- it is a German business account – and free of charge,

- you can categorize your income and expenses virtually and have a great overview of your finances,

- the account can be opened in a flash,

- Kontist is a young start-up and future-oriented,

- can be used together with debitor

Cons

- the decimal place is rounded in the overview

- there is (yet) no EC card